Bloomberg Dollar Spot Index

The Bloomberg Dollar Spot Index (BBDXY) tracks the performance of a basket of 10 global currencies against the U.S. dollar.

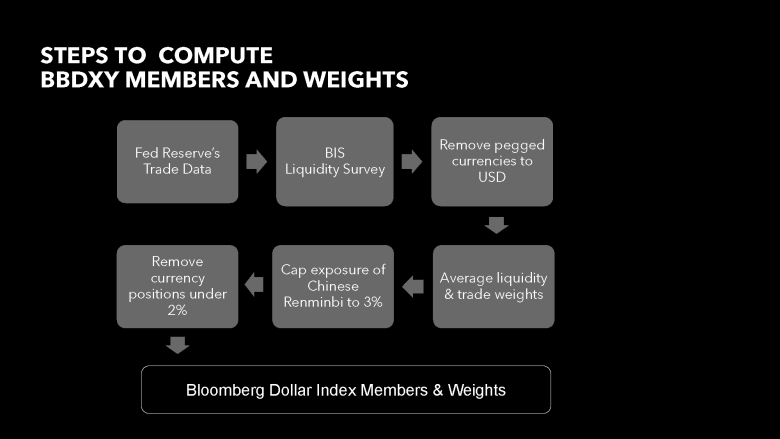

The index rebalances once a year to incorporate new data from:

- The annual survey of major trading partners versus the U.S. dollar as reported by the Federal Reserve.

- The triennial survey of most liquid currencies as reported by the Bank of International Settlements (BIS).

Composition

Calculation

- Identify the top 20 currencies in terms of trading activity versus the underlying currency. For the U.S. dollar, this is as defined by the Federal Reserve in its Broad Index of the Foreign Exchange Value of the Dollar.

- Identify the top 20 currencies from the Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity. Specific information about foreign exchange turnover can be found here.

- Select the top 10 currencies of both lists, but exclude any pegged currencies. For example, currencies pegged to the U.S. dollar (such as the Hong Kong dollar or Saudi riyal) are removed for the Bloomberg Dollar Spot Index.

- Assign a preliminary weight for each currency based on its trade weight and liquidity weight.

- Cap the exposure of Chinese renminbi and remove smaller currency positions, defined as any position that has a weight of less than 2%.

- Voila! BBDXY calculation complete!

META

Status:: #wiki/notes/mature

Plantations:: Finance - 20230221102436

References:: Babypips