Bond

Bonds are an investment without too much risk.

Indeed, the only risks are :

- Bankruptcy of the borrower

- Inflation that grows faster than the bond

Bonds allow you to know where you are going and what you will get.

Bond yield refers to the rate of return or interest paid to the bondholder while the bond price is the amount of money the bondholder pays for the bond.

Bond prices and bond yields are inversely correlated. When bond prices rise, bond yields fall and vice-versa.

Correlation with Currencies

Bond yields actually serve as an excellent indicator of the strength of a nation’s stock market, which increases the demand for the nation’s currency.

A rising yield is dollar bullish. A falling yield is dollar bearish.

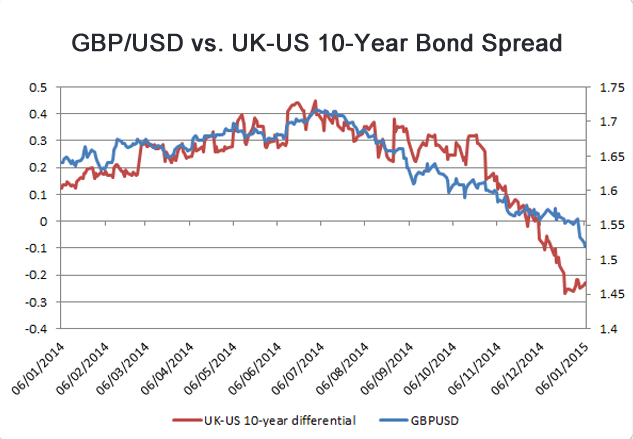

There is also a relationship with bonds spreads.

When bond spreads were increasing between the Aussie bonds and U.S. Treasuries, traders load up on their long AUD/USD positions.

Another example:

META

Status:: #wiki/notes/mature

Plantations:: Investment

References:: La Bourse pour les nuls