Directional Bias

Having a directional bias means that you expect the market to move in a certain direction once the news report is released.

We have to find the consensus and trade according to its expectations.

It’s important to keep track of the market consensus and the actual numbers, you can better gauge which news reports will actually cause the market to move and in what direction.

When the consensus is different than actual numbers, there can be big moves.

How to

We want to look first at the global sentiment to see if the weight of the news is bigger than the one of the overall trend.

Then, you want to find your bias. For example, if the unemployment rate is in an uptrend, you will have a short bias.

Particularly, you feel like you could short USD/JPY.

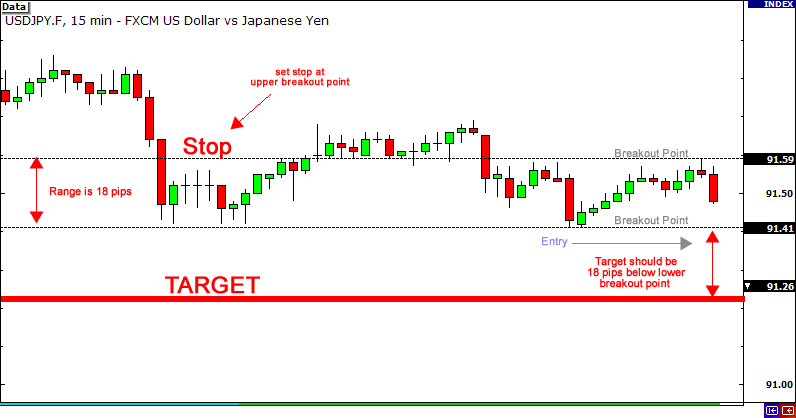

Just before the unemployment rate is about to be announced, you could look at the price movement of USD/JPY at least 20 minutes prior and find the range of movement.

Take note of the high and low that are made. These will become your breakout points.

META

Status:: #wiki/notes/mature

Plantations::

References:: Babypips